VA/FHA Loan Addendum 2013-2026 free printable template

Show details

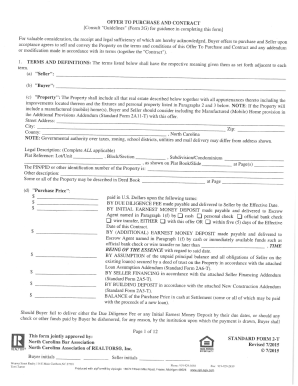

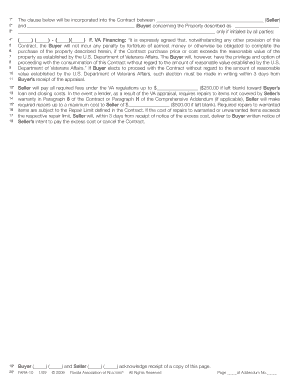

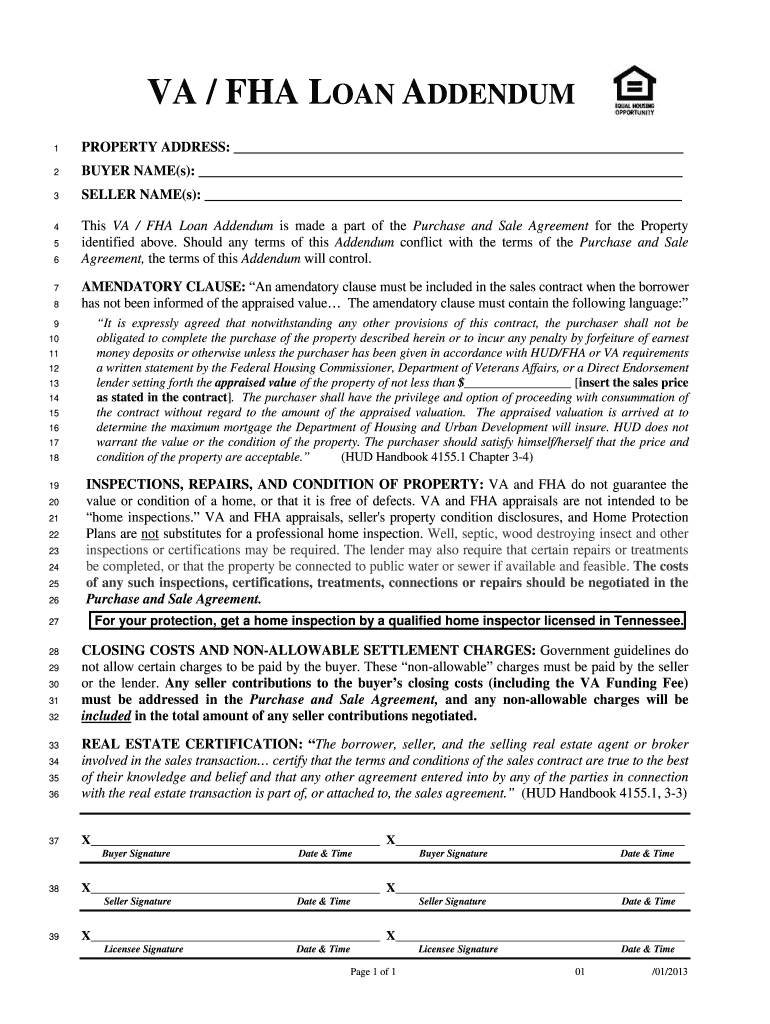

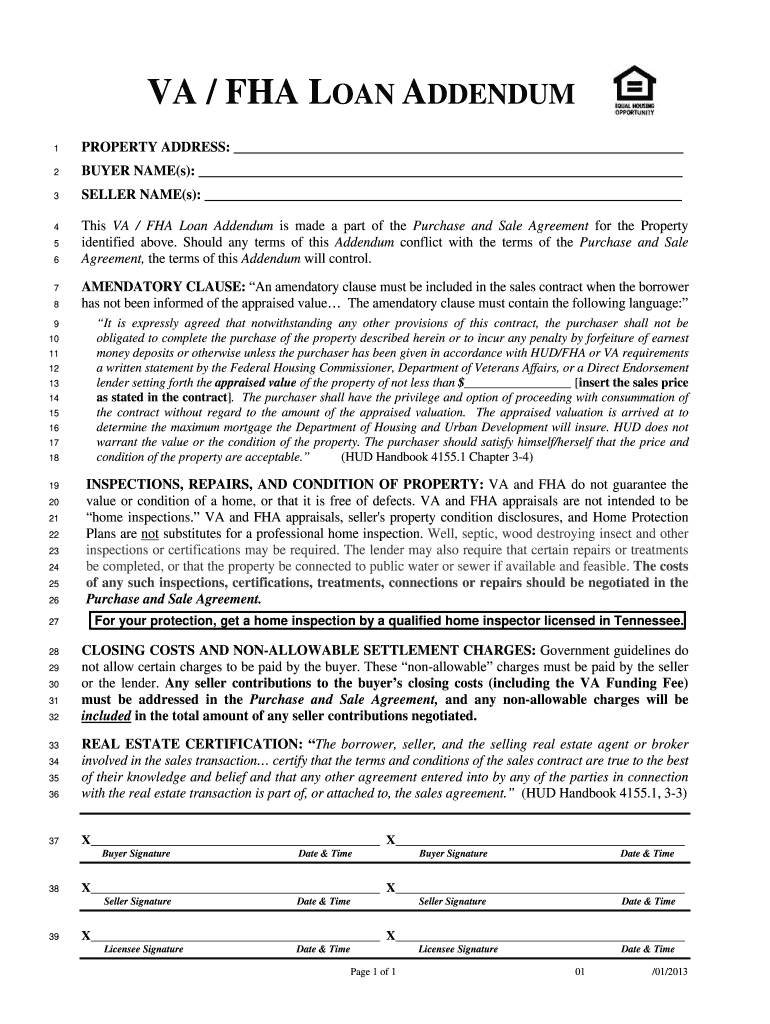

Reset the Form VA / FHA LOAN ADDENDUM PROPERTY ADDRESS BUYER NAME s SELLER NAME s This VA / FHA Loan Addendum is made a part of the Purchase and Sale Agreement for the Property identified above. Should any terms of this Addendum conflict with the terms of the Purchase and Sale Agreement the terms of this Addendum will control. AMENDATORY CLAUSE An amendatory clause must be included in the sales contract when the borrower has not been informed of the appraised value The amendatory clause must...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign va fha loan addendum form

Edit your fha purchase agreement addendum form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha addendum to purchase agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fha addendum online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fha purchase agreement addendum pdf form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA/FHA Loan Addendum Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fha va financing addendum form

How to fill out VA/FHA Loan Addendum

01

Obtain the VA/FHA Loan Addendum form from your lender or the official website.

02

Review the form carefully to understand the information required.

03

Fill in the property address at the top of the form.

04

Provide the buyer's name and contact information.

05

Indicate the loan type (VA or FHA) in the specified section.

06

Include loan amount and any seller concessions in the appropriate fields.

07

Review any additional disclosures and requirements mentioned in the addendum.

08

Sign and date the form where indicated.

09

Submit the completed addendum to your lender along with your loan application.

Who needs VA/FHA Loan Addendum?

01

Homebuyers applying for a VA or FHA loan.

02

Real estate agents involved in transactions with VA or FHA loans.

03

Lenders processing VA or FHA loan applications.

04

Sellers who are negotiating terms with buyers using VA or FHA financing.

Fill

fha financing addendum

: Try Risk Free

People Also Ask about va addendum to purchase contract

What is the FHA addendum clause?

Also called an “Escape Clause,” the FHA amendatory clause is a disclosure that gives FHA homebuyers extra protection to cancel a transaction and receive a refund of any upfront earnest money if the value of the home is below the agreed-upon sales price.

When must the FHA amendatory clause be signed?

The buyer, co-buyer (if applicable), seller, buyer's agent, and seller's agent are all required to sign the FHA amendatory clause before the lender performs the necessary appraisal on the home.

What is the FHA financing addendum in Maryland?

Definition of FHA Financing Addendum In Maryland, an addendum is often included in a real estate transaction to outline the terms and conditions of an FHA loan. This document, typically added to the sales contract or mortgage agreement, specifies the responsibilities of the buyer, seller, and lender.

What is an FHA financing addendum?

An FHA/VA financing addendum is attached to a purchase contract to state that a buyer with FHA/VA financing can back out of the sale if the appraised property value is less than the asking price.

Is the FHA addendum required?

The buyer, co-buyer, seller, buyer's agent and seller's agent must sign the FHA amendatory clause. The FHA will not insure or guarantee the loan if it's not signed.

Who provides the FHA addendum?

The buyer, co-buyer (if applicable), seller, buyer's agent, and seller's agent are all required to sign the FHA amendatory clause before the lender performs the necessary appraisal on the home. It's required that each party involved sign the clause for the deal to go through.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete fha amendatory clause form 2021 pdf online?

pdfFiller has made it easy to fill out and sign va agreement addendum fillable. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit fha addendum florida in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your fha addendum va loan, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the fha addendum form electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your va fha addendum fill.

What is VA/FHA Loan Addendum?

The VA/FHA Loan Addendum is a document that accompanies a loan application for properties financed through the VA (Veterans Affairs) or FHA (Federal Housing Administration) loan programs. It includes specific terms and conditions applicable to these types of loans.

Who is required to file VA/FHA Loan Addendum?

The borrower and the lender are typically required to file the VA/FHA Loan Addendum to ensure all parties agree to the terms set forth in the addendum as part of the mortgage transaction.

How to fill out VA/FHA Loan Addendum?

To fill out the VA/FHA Loan Addendum, the borrower must provide specific information including loan details, property information, and any required disclosures. This may involve completing sections accurately and signing where indicated.

What is the purpose of VA/FHA Loan Addendum?

The purpose of the VA/FHA Loan Addendum is to clarify the terms of the loan, outline specific requirements related to VA/FHA financing, and ensure compliance with relevant laws and regulations.

What information must be reported on VA/FHA Loan Addendum?

The VA/FHA Loan Addendum must report information such as the loan amount, interest rate, property address, terms of the agreement, and any relevant disclosures regarding the borrower and the loan process.

Fill out your VAFHA Loan Addendum online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Va Agreement Addendum Printable is not the form you're looking for?Search for another form here.

Keywords relevant to fha loan addendum

Related to fha addendum latest

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.